Introduction to Bitcoin: What is It?

Bitcoin, often referred to as BTC or XBT, is a revolutionary digital currency that has gained significant attention in recent years. It operates on a decentralized network, which means it is not controlled by any central authority, such as a government or financial institution. This unique characteristic has led to its growing popularity among individuals and businesses worldwide. In this article, we will delve into what Bitcoin is, how it works, and its implications for the global financial system.

Origin and History of Bitcoin

The concept of Bitcoin was first introduced in a white paper published by an individual or group of individuals using the pseudonym Satoshi Nakamoto in 2008. The paper outlined a decentralized digital currency system that would operate without the need for a central authority. The first Bitcoin was created on January 3, 2009, with the release of the Bitcoin software. Since then, Bitcoin has evolved into a global phenomenon, with millions of users and a market capitalization that has reached billions of dollars.

How Bitcoin Works

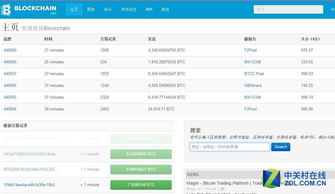

Bitcoin operates on a technology called blockchain, which is a decentralized ledger that records all transactions made with Bitcoin. This ledger is maintained by a network of computers, known as nodes, that work together to validate and record transactions. When a user wants to send Bitcoin to another user, the transaction is broadcast to the network, and nodes compete to solve a complex mathematical problem. The first node to solve the problem is rewarded with Bitcoin, and the transaction is added to the blockchain.

Bitcoin Mining

Bitcoin mining is the process by which new Bitcoin is created and transactions are added to the blockchain. Miners use specialized hardware and software to solve the complex mathematical problems that validate transactions. This process is energy-intensive and requires significant computing power. In return for their efforts, miners are rewarded with Bitcoin, which helps to secure the network and incentivize participation.

The Supply and Distribution of Bitcoin

The supply of Bitcoin is capped at 21 million coins, which is designed to prevent inflation and control the money supply. This limit is reached through a process called halving, where the reward for mining new Bitcoin is halved approximately every four years. This mechanism ensures that the rate of Bitcoin creation decreases over time, similar to precious metals like gold.

Advantages and Disadvantages of Bitcoin

Bitcoin offers several advantages over traditional fiat currencies, including its decentralized nature, lower transaction fees, and increased privacy. However, it also has its drawbacks. The volatility of Bitcoin's value can be a significant risk, and its use is not yet widely accepted by merchants and businesses. Additionally, the lack of regulation and oversight can make Bitcoin a target for fraud and money laundering.

The Future of Bitcoin

The future of Bitcoin remains uncertain, but it is clear that it has the potential to disrupt traditional financial systems. As more individuals and businesses adopt Bitcoin, its value and utility are likely to increase. However, regulatory challenges and technological advancements could also impact its future. Only time will tell how Bitcoin will evolve and what role it will play in the global economy.

Conclusion

Bitcoin is a groundbreaking digital currency that has the potential to reshape the financial landscape. Its decentralized nature, innovative technology, and unique characteristics have made it a topic of interest for investors, businesses, and policymakers worldwide. While Bitcoin faces challenges and uncertainties, its impact on the global financial system is undeniable. As we continue to explore the possibilities of this digital currency, it is essential to understand its origins, workings, and implications for the future.

Tags: Bitcoin DigitalCurrency Blockchain Decentralization Crypto Finance Investment Technology